Condo Insurance in and around Circle Pines

Condo unitowners of Circle Pines, State Farm has you covered.

Insure your condo with State Farm today

Home Is Where Your Condo Is

Looking for a policy that can help insure both your unit and the cookware, appliances, furnishings? State Farm offers impressive coverage options you don't want to miss.

Condo unitowners of Circle Pines, State Farm has you covered.

Insure your condo with State Farm today

Agent Mark Peterson, At Your Service

When a windstorm, fire or a tornado cause unexpected damage to your condominium or someone falls on your property, having the right coverage is significant. That's why State Farm offers such terrific condo unitowners insurance.

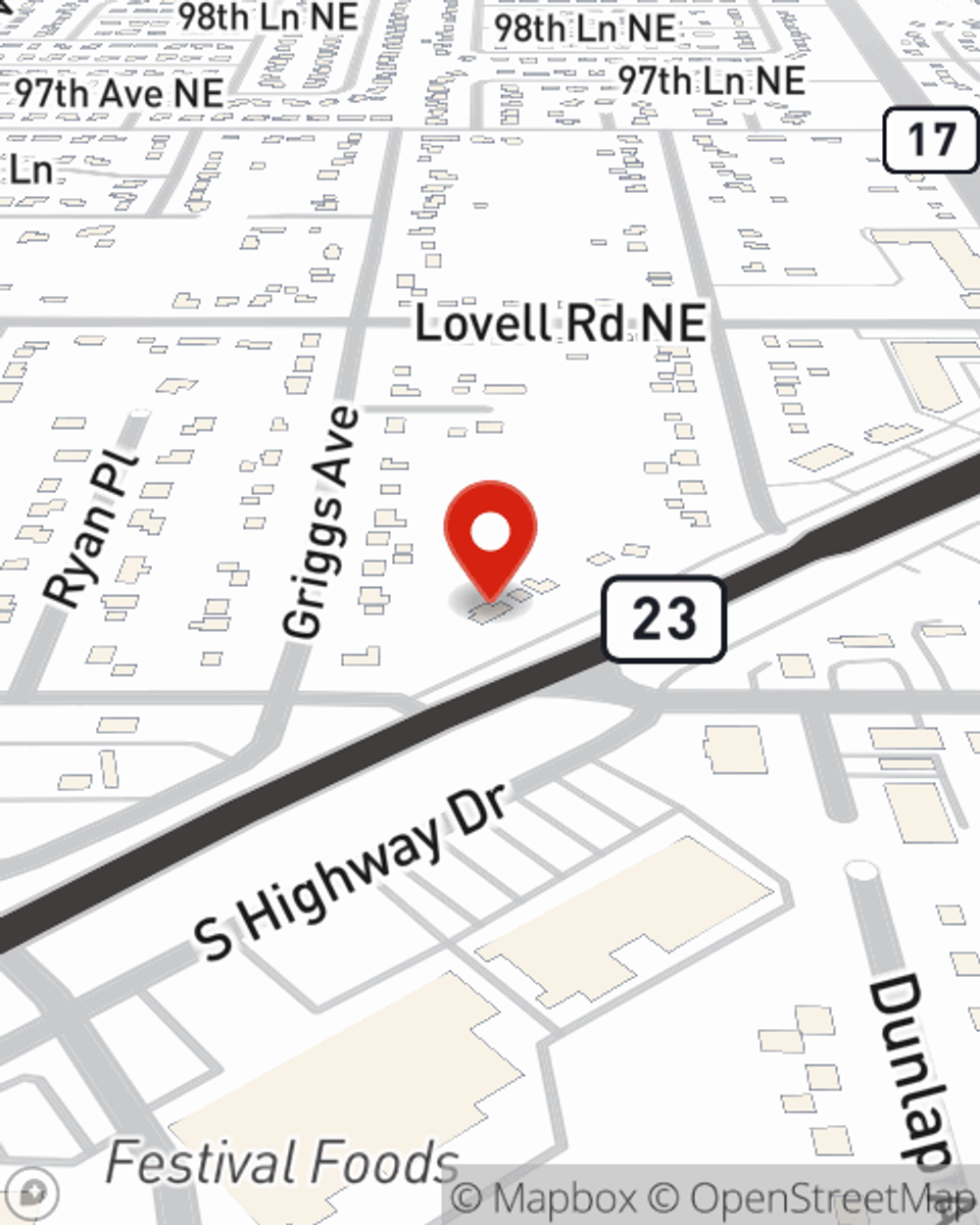

That’s why your friends and neighbors in Circle Pines turn to State Farm Agent Mark Peterson. Mark Peterson can outline your liabilities and help you make sure your bases are covered.

Have More Questions About Condo Unitowners Insurance?

Call Mark at (763) 786-3087 or visit our FAQ page.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Mark Peterson

State Farm® Insurance AgentSimple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.